Tax-Deductible Expenses: Are You Recording All of Them?

Posted on 17 October 2017

2017 income tax preparation seems a long way off. Make it easier by tracking all the deductions you can take.

You've heard it said before: Tax planning should be a year-round process. It's so true. Your life will be a lot easier early next year when all your tax forms start rolling in.

Forms like 1099s and W-2s do a lot of the tracking for you. You only need to transfer data over to your IRS tax forms and schedules. But what about the daily stuff, the expenses you incur as a part of your workday that no one else is documenting? There are a lot of tax-deductible costs that can really add up when it's time to file.

The IRS has two criteria for evaluating the validity of business expenses. First, is it ordinary? Is it something that other companies in your trade or profession would commonly buy? Second, is it necessary? Is it "...helpful and appropriate?"

Warning: Some expenses that you think might be deductible are not. Obviously, you can't claim the costs of personal items. The IRS specifies two other types of expenses that can't be deducted: Capital Expenses and those used the calculate the Cost of Goods Sold. Questions? Ask your accountant

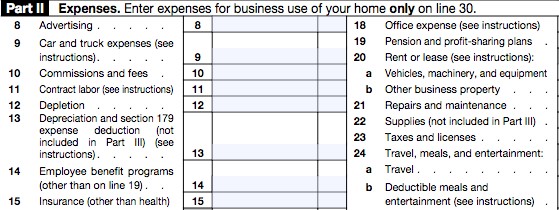

Pulling together all that numbers required for the IRS Schedule C can be challenging.

Here are some examples of expenses that you might not consider, but which should be recorded as they occur so you don't forget about them come tax time.

Advertising and promotion

Some of these expenses are obvious. For example, you might report printing costs for brochures, ad space bought, and postage for mailers and other business correspondence. But there's much more that fits into this category. Think about everything you do that helps promote your business, like expenses related to:

- Business cards

- Team sponsorships

- Your website (including startup and maintenance fees)

- Graphic design

- Workshops/webinars

Insurance

Do you have any kind of business insurance, like liability or malpractice? Your premiums are deductible.

Car and truck expenses

Understandably, you can only deduct expenses for miles driven for business purposes. If you have a vehicle-either owned or leased-that you also use for personal driving part of the time, you'll need to track those two separately.

There are two options for calculating business mileage: Actual Expenses and Standard Mileage. To calculate the latter, you'd multiple the number of business miles driven by 53.5 cents for tax year 2017, then add tolls and parking fees. The Actual Expense Method is more complicated; it involves many costs, and recognizes depreciation of the vehicle. Check with us if you're planning to claim expenses for a car or truck, as there are additional rules governing this deduction.

There are two options for calculating business mileage: Actual Expenses and Standard Mileage. To calculate the latter, you'd multiple the number of business miles driven by 53.5 cents for tax year 2017, then add tolls and parking fees. The Actual Expense Method is more complicated; it involves many costs, and recognizes depreciation of the vehicle. Check with us if you're planning to claim expenses for a car or truck, as there are additional rules governing this deduction.

Postage and office supplies

Yes, they're deductible if you need them for your business.

Meals and entertainment

Familiarize yourself with the rules for this one. They're complicated, and the IRS looks closely at such deductions.

Business use of your home

Ditto. There are all kinds of regulations, restrictions, and exceptions here, even if you use the simplified method that the IRS introduced a few years ago. The rules are very specific and very rigid. For example, even if you use your home's land line for business, you can't deduct it. Add another line for business, and you can.

Professional and legal fees

If you pay an individual or firm for services provided to help you operate your business, those fees are often deductible. This includes lawyers, accountants, and tax preparers, of course, but as always, there are exceptions. You can't usually, for example, deduct attorneys' fees if you were getting legal help to buy business assets.